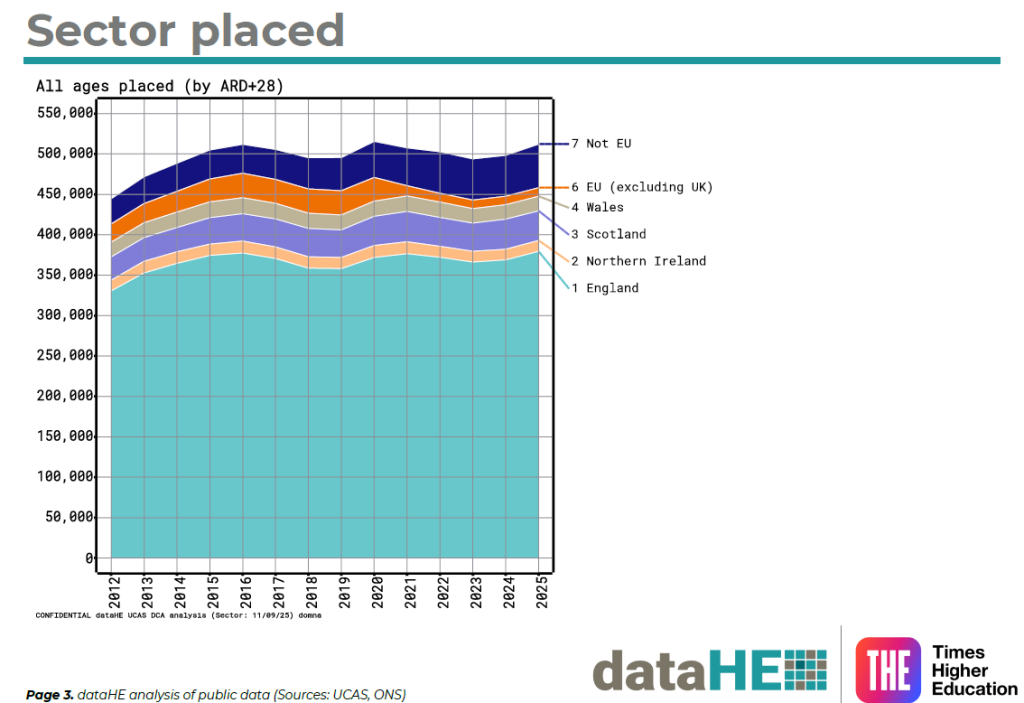

The latest UCAS acceptance figures, covering data up to 11 September – four weeks on from results day – analysed alongside insights from Data HE, reveals a sector that is expanding overall but with notable shifts in what is driving the growth. This year, total placements have reached 512,270, up from 498,340 in 2024 – an increase of nearly 14,000 students (+2.8% year-on-year). Beneath this headline, however, lie widening differences between tariff groups, shifts in subject preferences, and an increasing reliance on key international markets.

-

Total placed: 512,270 (2024: 498,340) → +13,930 (+2.8% YoY).

-

Placed rate: 77%, up slightly from 76% in 2024.

-

UK growth dominates in absolute terms (+11k, +2.5%), while international growth is stronger proportionally (+4k, +6.6%).

-

Higher tariff providers lead the way, with record intakes from both UK (+8k) and international (+4k) students.

-

Medium tariff providers remain stable, reaching a record UK intake but flat international numbers.

-

Lower tariff providers are under pressure, with losses of around 3,000 UK and 1,000 international students, and no late-cycle international uplift this year.

-

Clearing hits a record high, with 18,460 students placed directly.

-

Late-cycle adjustments are flatter than in previous years, as more students secured places on Results Day itself.

-

Subjects realign, with strong growth in STEM, business, psychology, creative arts, and law; computing easing back; and education and languages continuing to fall.

-

International reliance deepens, with growth underpinned by China and India.

1. Provider Performance (by tariff group)

Higher tariff providers continue to strengthen their position. Around 115,000 UK students were placed this year, up by 8,000 on 2024, alongside 24,000 international students, up by 4,000. This marks a record intake, with growth at both domestic and international levels.

Medium tariff providers saw around 105,000 UK students placed, marginally higher than last year, while international recruitment held steady at ~11,000. UK numbers reached record highs, but international volumes were flat.

Lower tariff providers faced challenges. UK placements fell to ~80,000 (down from ~83,000 in 2024), while international numbers dipped slightly to ~6,000. The absence of late-cycle international gains, which have supported lower tariff providers in recent years, has added pressure.

Tariff group contrast (2025 vs 2024):

-

Higher tariff: up 12k students (UK +8k, +7%; International +4k, +20%).

-

Medium tariff: essentially flat.

-

Lower tariff: down 4k students (UK -3k, -3.6%; International -1k, -14%).

2. Sector-Level Growth (Milestones)

| Stage | 2024 Total | 2025 Total | Change | % YoY |

|---|---|---|---|---|

| Results Day | 425,680 | 439,180 | +13,500 | +3.2% |

| Results Day +1 | 442,380 | 453,900 | +13,800 | +3.1% |

| Two Weeks (+14d) | 487,890 | 499,480 | +13,510 | +2.8% |

| Four Weeks (+28d) | 498,340 | 512,270 | +13,930 | +2.8% |

At every stage of the cycle, 2025 tracked around 3% ahead of 2024 – equivalent to an extra 13-14,000 students. UK applicants accounted for most of this uplift (+11–13k), while international growth added 2–4k per stage. By Day 28, UK recruitment was up 2.5% year-on-year, while international recruitment grew faster, at 6.6%.

3. 18-Year-Old Dynamics

This year saw the largest ever intake of UK 18-year-olds, with more than 300,000 securing places. Around 60,000 remain unplaced – above pre-2019 levels, but below the exceptional peaks of 2020–21.

Clearing continues to play a pivotal role, with a record 18,460 direct placements. However, overall late-cycle growth remained flat compared with last year, as more students secured offers earlier in the cycle.

Subject Shifts:

-

Growing: Engineering & Technology, Business & Management, Psychology, and Law.

-

Declining: Computing (after years of strong growth), Education, and Languages.

-

Stable: Medicine & Dentistry (~11–12k).

Overall, most major subjects grew in 2025, with only a few easing back.

4. Entry Rates & Access

Around 36% of UK 18-year-olds entered higher education through UCAS in 2025 – the same proportion as in 2024, but still below the 2021 peak.

Entry rates for disadvantaged students have doubled since 2012, but remain significantly lower than those of the most advantaged, at approximately 24%. The rapid expansion of the 2010s has slowed, suggesting access progress is becoming harder to achieve.

5. International Recruitment

International growth continues, but is heavily reliant on a small number of markets:

-

China: ~18,000 acceptances.

-

India: ~7,000, showing the fastest proportional growth.

-

Other markets (Nigeria, Malaysia, UAE, Hong Kong, USA) remain largely flat.

This reliance on China and India underpins current growth, but also creates strategic risk given ongoing policy and geopolitical uncertainties.

6. Financial Outlook

Tuition fee income across the sector is projected to reach just over £6bn in 2025, a modest increase from ~£5.9bn in 2024 and up from ~£4bn a decade ago.

-

Higher tariff providers are benefitting most, consolidating financial strength through both domestic and international growth.

-

Lower tariff providers are struggling, with smaller UK cohorts and international losses eroding income potential.

The 2025 admissions cycle shows a sector still growing – but not evenly. Higher tariff providers are accelerating ahead, international recruitment is increasingly concentrated in two key markets, and subject choices are shifting in ways that will reshape provision over the next decade. Meanwhile, lower tariff institutions face sustained pressure, and widening access remains a challenge.

If you’re looking for help making sense of the data—and turning it into a bullet-proof recruitment strategy—we’d love to talk. Email Kim McLellan.