Demand is still strong – but increasingly concentrated

Keystone’s Share of Search data shows global appetite for UK study climbing sharply: +79% in Asia, +78% in Africa, +43% in the Americas, +17% in Oceania, and +10% in Europe (Q2 2025 vs Q2 2024). This represents big year-on-year increases in search activity, raising the key question: Is this surge interest actually translating into enrolments?

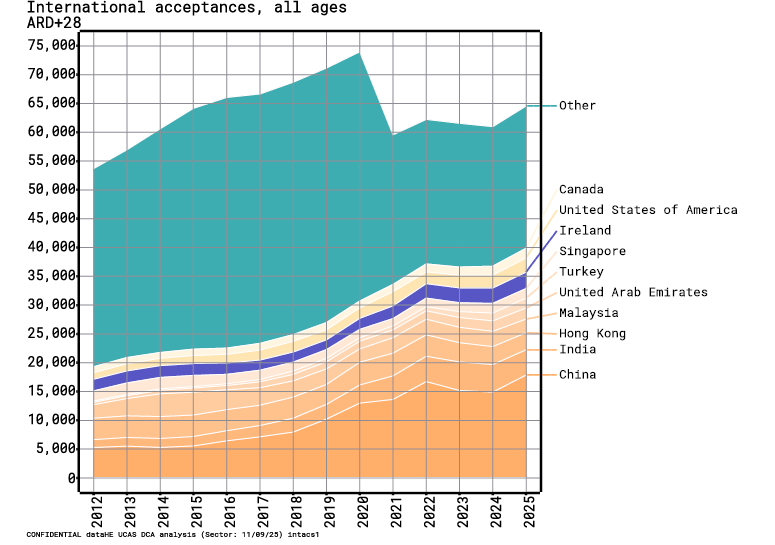

UCAS Day-28 acceptances confirm how that interest converted. While global search demand has risen despite the UK’s recent policy changes, those same policy shifts – around dependants, affordability and post-study work – are highly visible to students. They don’t stop them from looking, but they can shape conversion at the final hurdle. The encouraging sign is that search growth has still carried through to solid enrolment numbers, though in a highly concentrated way.

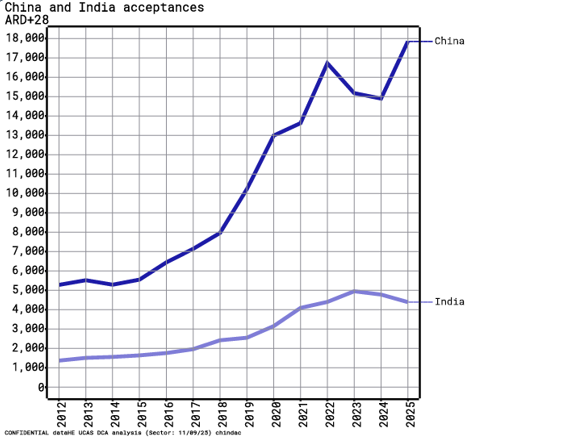

- China ~18,000 acceptances

- India ~7,000 acceptances

Together, these two markets now represent 40% of all international acceptances – up from under 30% in 2019. - Other major markets (Nigeria, Malaysia, UAE, Hong Kong, USA) remain largely flat.

UCAS International Acceptances 2025

How students perceive the UK

Keystone’s survey compared the UK to the other major destinations – the US, Canada and Australia – across key decision factors. The results show a nuanced picture:

- Strengths: the UK ranked first for academic reputation, distinctive subjects, safety, culture, and visa and entry requirements.

- Weakness: the UK came last for affordability, a perception that continues to harden as tuition fees and living costs rise.

This affordability gap is increasingly critical. Keystone’s 2025 Pulse Survey data shows:

- 81% of students now cite cost as a barrier (+7% year-on-year)

- 27% highlight political uncertainty (+59%)

- 14% question value and career outcomes (+17%)

Much of this perception is shaped by London’s reputation as one of the most expensive cities in the world to live and study. While that view isn’t entirely inaccurate, it can be misleading if not explained in context. The reality is that costs vary widely across the UK, with smaller cities and regions often offering far more affordable living expenses than global competitors like the US, Canada, or Australia. For universities, this creates a communications challenge: being transparent about real costs, showing where students can make savings, and demonstrating value for money – clear messaging can shift perceptions from “too expensive” to “worth the investment.”

Recent reporting has brought these issues into sharper relief. The Guardian (22 Sept 2025) revealed that the government is considering visa fee cuts for top global talent — a clear signal that affordability and competitiveness are firmly on the agenda. This comes at the same time as the US has introduced a $100,000 fee for new H-1B visa applications, a massive jump from the few thousand dollars typically charged before.

Meanwhile, Times Higher Education (11 Sept 2025) reported that sponsored study visa applications rose 2% year-on-year to 427,100 in the year to August 2025, suggesting a modest recovery even amid affordability concerns and ongoing policy uncertainty.

Shifts in study preferences

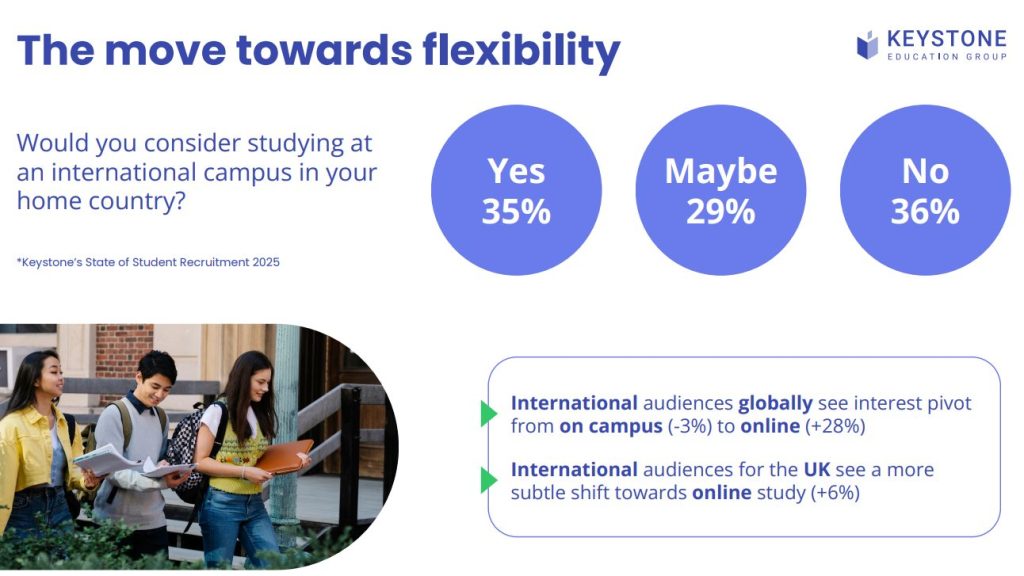

Keystone data shows flexibility is increasingly part of the conversation. Globally, student interest is shifting from on-campus (-3%) to online (+28%), while in the UK, the move is more modest at +6% towards online study. Keystone also asked whether students would consider studying at an international campus in their home country.

Keystone Flexibility in Study Preferences

Converting interest into enrolments

All of this raises the critical question for the sector: with global search interest rising, UCAS acceptances concentrated, and affordability concerns mounting, how can UK universities turn strong interest into actual enrolments?

The answer lies in proving value clearly – by highlighting placement rates, graduate salaries, and real alumni stories that show outcomes. Institutions also need to own the visa narrative, offering timely, plain-language updates that build trust. Conversion journeys must respond to the growing number of students deciding within six months, with faster, more personalised follow-up. Rather than trying to chase every market, smart diversification means identifying subject-market niches and focusing resource there. And for mid-tier universities, it’s time to play to your strengths – intimacy, access, and strong city links can be just as compelling as rankings or prestige.

As our MD, Kim Mclellan puts it:

“International recruitment is still robust, but harder won”

The UK remains attractive, but trust, affordability, and outcomes are now the real battlegrounds. Universities that adapt quickly will be the ones that continue to grow in 2026.

Need help shaping your international student recruitment strategy? Email Kim McLellan.